💸Chuck Akre's Three-Legged Stool

Chuck Akre is an extremely successful investor that used to run $15 Billion through his fund before retiring. Here is his timeless approach to investing that you can follow today.

Chuck Akre founded Akre Capital Management in 1989, and today the fund’s portfolio is valued at $15 Billion!

The incredible thing about Akre Capital Management is the simplicity of their investment philosophy.

It doesn’t involve complex mind boggling equations or supercomputers trading in derivatives - it is based on a simple three-legged stool analogy that anyone can follow.

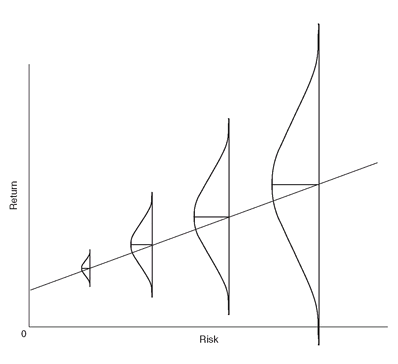

The three-legged stool approach aims to find superior businesses that earn above average return on capital.

This metaphoric stool symbolises stability and durability, with each leg describing what Chuck Akre looks for in an investment.

1. Extraordinary business

The first leg of the three-legged stool considers whether a business is extraordinary.

Firstly, to determine if a business is extraordinary, you need to be able to understand the business. This begs the question - is the business easy to understand? Do you know how it generates profit and what it’s competitive advantage is?

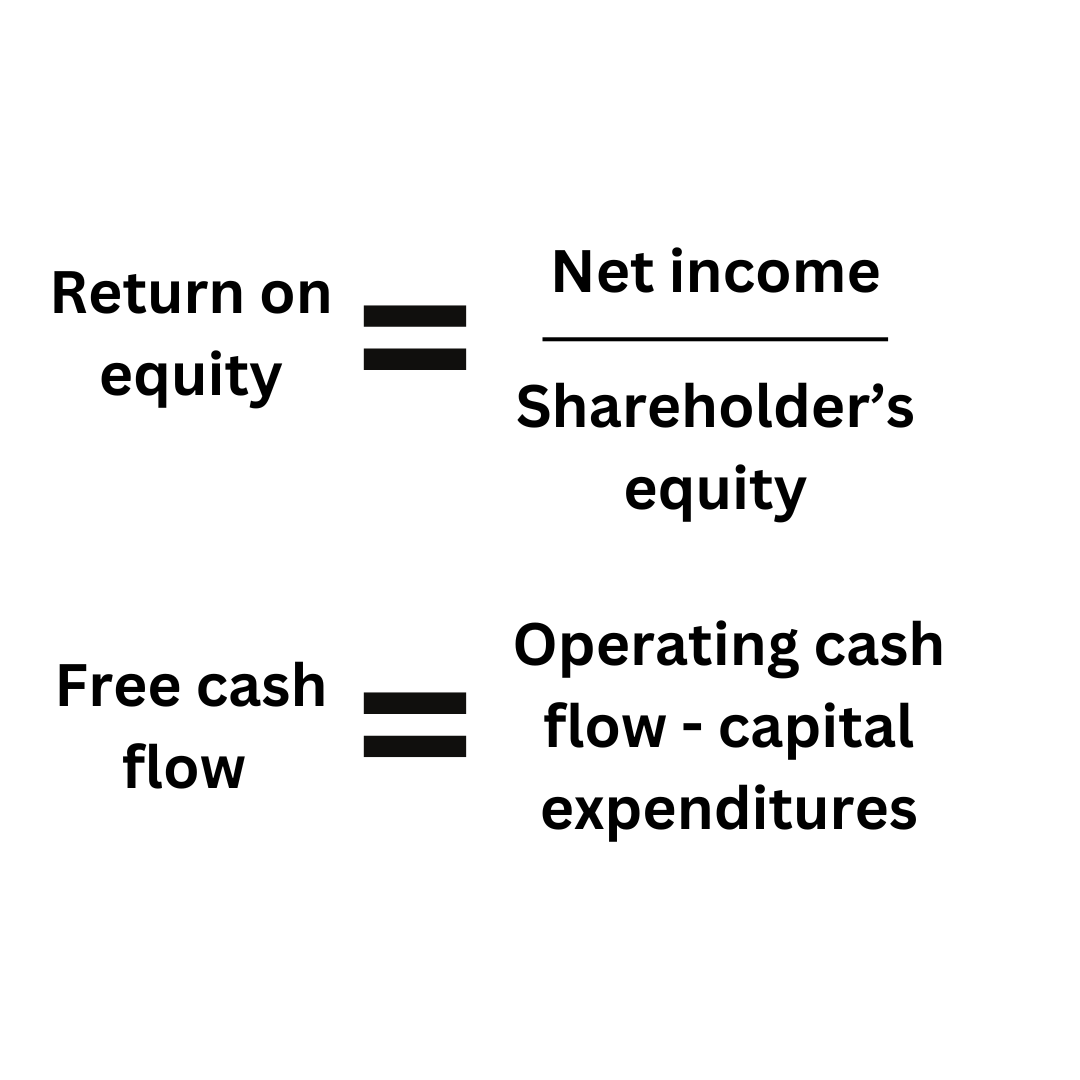

The next step is to consider the numbers. Chuck Akre’s approach looks at the strength of the balance sheet, the ROE (return on equity), and the FCF (free cash flow).

ROE gives an insight into how efficient a company is in generating profit. Free cash flow tells us how much cash a business generates after deducting operating and capital expenditures. Here is how to calculate them:

Another thing Chuck Akre considers is the pricing power of a business - i.e. the ability of the company to raise the price of its products without impacting demand.

The company with the ultimate pricing power is arguably Coca-Cola. Let’s say tomorrow Coca-Cola decided to increase the price of its products by 1 cent. Coca-Cola products are so well known and loved, it likely wouldn’t impact demand.

Currently, 1.9 billion Coca-Cola products are enjoyed every day. An extra cent would result in an additional $7 billion in annual pre tax profits.

This explains the advantage of companies with pricing power.

2.Talented Management

The next leg of the stool represents the ability of management.

A couple of great books on superior management are William Thorndike’s The Outsiders and Jim Collins’ Good to Great.

Here’s some key characteristics mentioned in the above books that superior managers have:

Level 5 Leadership: Collins introduces the concept of Level 5 Leadership, where leaders blend personal humility with professional will. These leaders are more focused on the success of the company than their personal success, creating a powerful combination of ambition and humility.

First Who, Then What: Exceptional leaders understand the importance of getting the right people on board before deciding on a strategic direction. They prioritize hiring individuals with a combination of skills, character, and commitment. The right people are the foundation for a successful organization.

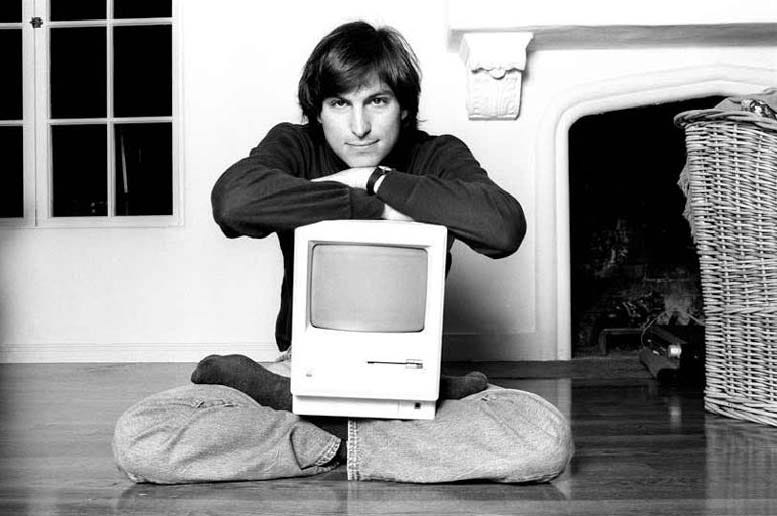

So I’ve built a lot of my success on finding these truly gifted people, and not settling for “B” and “C” players, but really going for the “A” players. And I found something… I found that when you get enough “A” players together, when you go through the incredible work to find these “A” players, they really like working with each other. Because most have never had the chance to do that before. And they don’t work with “B” and “C” players, so it’s self-policing. They only want to hire “A” players. So you build these pockets of “A” players and it just propagates.

-Steve Jobs

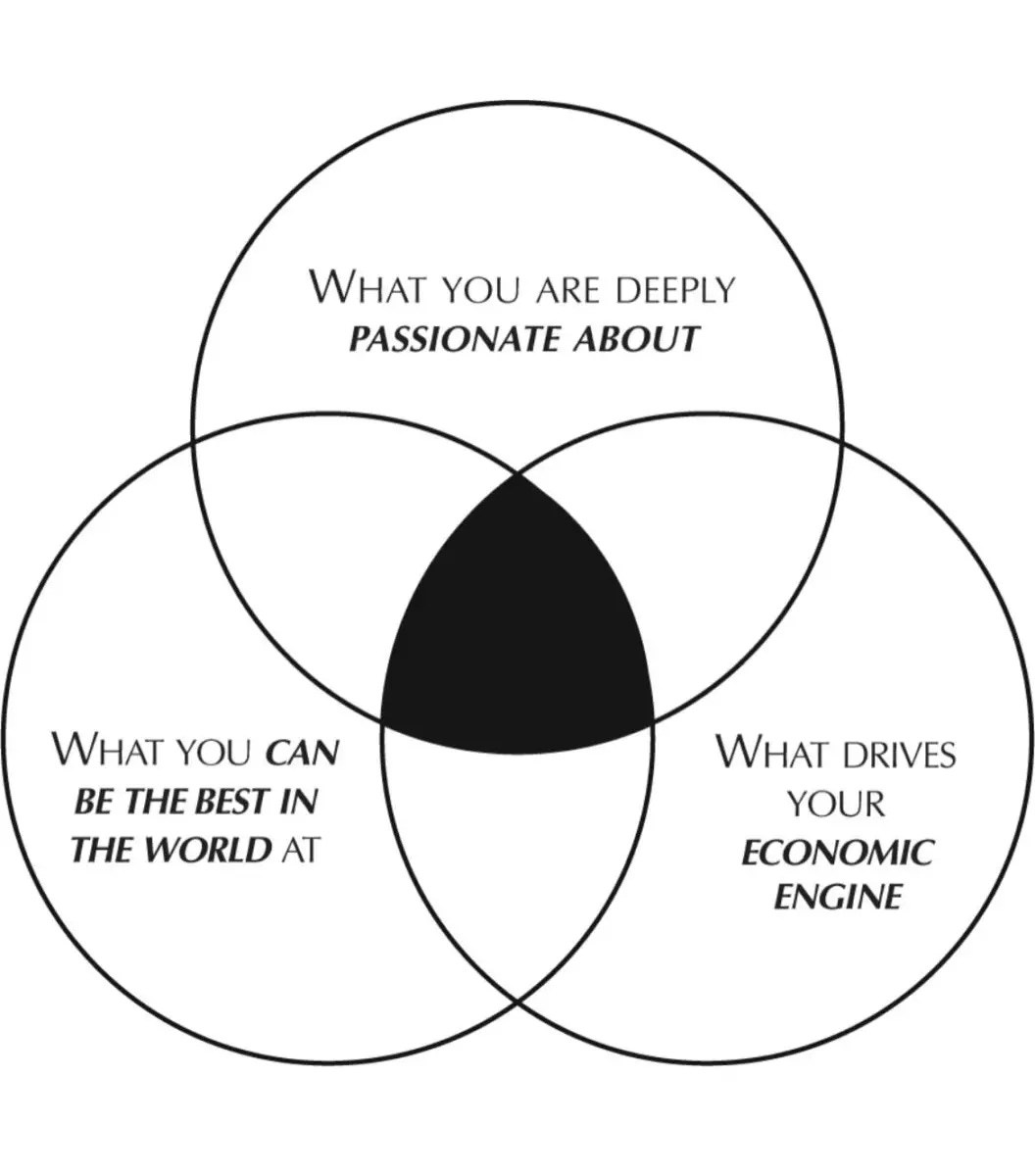

Hedgehog Concept: The Hedgehog Concept involves finding the intersection of three crucial circles: what you are deeply passionate about, what you can be the best in the world at, and what drives your economic engine. Exceptional leaders guide their organizations to focus on this intersection, avoiding distractions and maintaining clarity of purpose.

Capital Allocation Mastery: Superior managers excel in capital allocation, meaning they have a keen ability to allocate resources to generate the highest returns for shareholders. They are adept in making strategic investment decisions, whether it is in acquisitions, share buybacks, or internal projects.

Focus on Cash Flow: Rather than being fixated on reported earnings, top leaders focus on generating substantial cash flow. They recognise that cash, not accounting profits, is the lifeblood of a business.

Long-Term Perspective: Talented managers are known for their long-term mindset. They resist the short-term pressures of quarterly earnings reports and stock market fluctuations. This allows them to make decisions that might not show immediate results but are beneficial for the sustained growth of the company.

Frugality and Efficiency: In William Thorndike’s book The Outsiders, superior CEO’s are known for their frugal approach to corporate expenses. They run efficient operations, avoiding unnecessary overhead and allocating resources judiciously - and put shareholders returns above all else.

Risk Management: While being unconventional risk-takers, the best leaders are also effective risk managers. They carefully assess risks and are willing to take bold steps when the potential rewards justify the risks.

Skin in the game: The best managers eat their own cooking. As an investor, you want to see that the people running the company also have a significant ownership in the business.

Rational incentive scheme: Superior leaders understand the power of incentives and have set up their incentive scheme to focus on direct business goals that leaders can influence to drive outperformance.

Show me the incentive and I'll show you the outcome.

-Charlie Munger

3.Great reinvestment opportunities

The final part of Akre’s three-legged stool is the ability of a company to reinvest its cash.

If an extraordinary business, run by exceptional managers is able to reinvest all its cash flow back into the business, this will enable the compounding effect to begin to take place.

Being able to reinvest cash back into a business, rather than take it out, is much more much efficient and beneficial to the stockholder too, as it allows the business to continue growing and also saves on taxes.

When we find a business that satisfies all three of our requirements, we refer to it as a “compounding machine,” and we seek to purchase shares at a modest valuation.

We know from experience that these businesses are rare.

-Chuck Akre

How Akre knows when to sell

The great thing about Chuck Akre’s investment approach is that it can also help to determine when it might be time to sell your investment - one of the most difficult decisions in the game.

We do not set sell price targets when we buy a security – we often say we are not looking for the exit on the way in – because we are not looking to simply trade securities based on their price movement.

Rather we are looking to compound the capital we manage, and have identified that investing in these “extraordinary” businesses, as we define them, is the BEST way to achieve our goal. We begin sell discussions when one or more of the legs of our stool is “broken or injured”. The outcomes over our years of experience clearly reinforce this notion.

-Chuck Akre

Akre Capital Management’s current portfolio

Need some inspiration for companies that meet Akre’s investment philosophy?

Here is Akre Capital Management’s portfolio, from Dataroma.com as of 30 Sept 2023: