🧠Mental Model: Second-Level Thinking

In this weeks #mentalmodel series we will look into second-Level thinking and delve into the importance this mental model plays in successful investing.

The foundation of the stock market is based on the universality of the profit motive - everyone wants to get rich. This makes investing very difficult, as millions of people are competing for the same slices of profit.

To get outstanding investment results and beat the averages, one must take a different approach when it comes to thinking about investments. One must be what legendary investor Howard Marks calls a second-level thinker.

Since other investors may be smart, well-informed, and highly computerised, you must find an edge they don’t have. You must think of something they haven’t thought of, see things they miss or bring insight they don’t possess.

-Howard Marks

What is second-level thinking?

Second-level thinking goes beyond the surface level. It is complex and deep. It is a more deliberate process. As such, participating in second-level thinking requires much more work than the fast and easy first-level thinking that most people engage in.

Here is a simple example to help distinguish between first-level thinking and second-level thinking:

Lets take the Prohibition, enacted through the 18th Amendment to the U.S. Constitution in 1920, aimed to curb the societal issues associated with alcohol consumption.

From a first-level thinking point of view, you would say that banning the production, sale, and transportation of alcoholic beverages would reduce crime, improve public health, and enhance overall social morality.

However, applying second-level thinking, you would go a step further and consider the knock-on impacts such as the rise of organised crime due to a lucrative black market for alcohol being created, public health issues resulting from unsafe homemade '“bathtub gin”, and the economic impact of the ban in terms of industry jobs losses and Government alcohol tax revenue losses.

In investing, being a second-level thinker will put you well on your way to achieving above average results, as it is a way to diverge from the consensus (although you must still be right in your investment forecasts, of course).

The prevalence of first-level thinkers increases the returns available to second-level thinkers.

-Howard Marks

Applying second-level thinking

Here are a few ways to try and apply second-level thinking:

Be curious and have a list of key questions to consider. Here’s a few example questions that a second-level thinker should contemplate, as shared in Howard Marks’ book The Most Important Thing:

What is the range of likely future outcomes?

Which outcome do I think will occur?

What’s the probability I’m right?

What does the consensus think?

How does my expectation differ from the consensus?

How does the current price for the asset comport with the consensus view of the future, and mine?

Is the consensus psychology incorporated in the price too bullish or bearish?

What will happen to the assets price if the consensus turns out to be right, and what if I’m right?

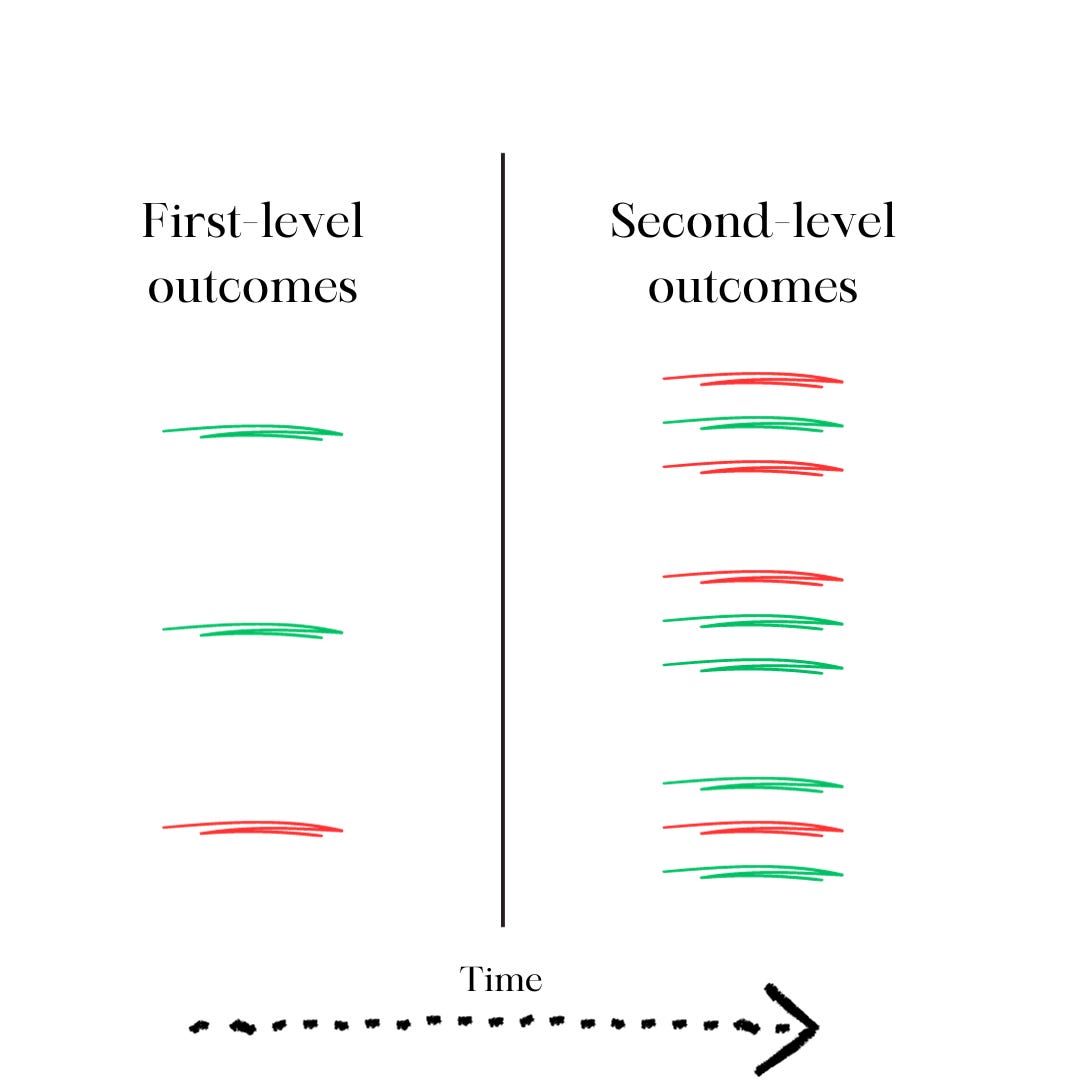

Visualise outcomes across time. Try to map out immediate outcomes and build on from these by considering knock-on outcomes. Think about these outcomes in relation to time - what will the competitive moat of this business be like in 10 years, due to this new technology?

Get into the habit of being a contrarian. When you see the consensus view on something, think about the opposite. For example, let’s say the majority of investors (first-level thinkers) are panic selling stocks due to economists predicting low growth and high inflation over the coming years. As a second-level thinker you would look at the facts, and ok, the economists may be right. The future isn’t too bright. However, the market might be overreacting, producing dollars selling for fifty cents - buy!